Unveiling Canadians' Economic Outlook

Insights from the First Quarter of 2024

Inflation, that ever-present economic indicator, is a hot topic among consumers. Recent data suggests a perceived slowdown in inflation, yet expectations for the near term remain relatively unchanged. Why the discrepancy? Sticky inflation expectations, it seems, are influenced by a mix of factors—from uncertain near-term inflation trajectories to persistent projections for interest rates and rent costs. In our latest quarterly analysis, we delve into the intricacies of consumer sentiment surrounding inflation. Despite perceptions of a temporary reprieve, long-term inflation expectations are on the rise. Domestic factors, such as government spending and housing costs, are viewed as enduring challenges, prolonging the inflation puzzle. Join Cashin Mortgages as we dissect the latest trends, implications, and insights driving consumer inflation sentiment in our quarterly report.

Canadian Perception vs. Expectation: Inflation Trends

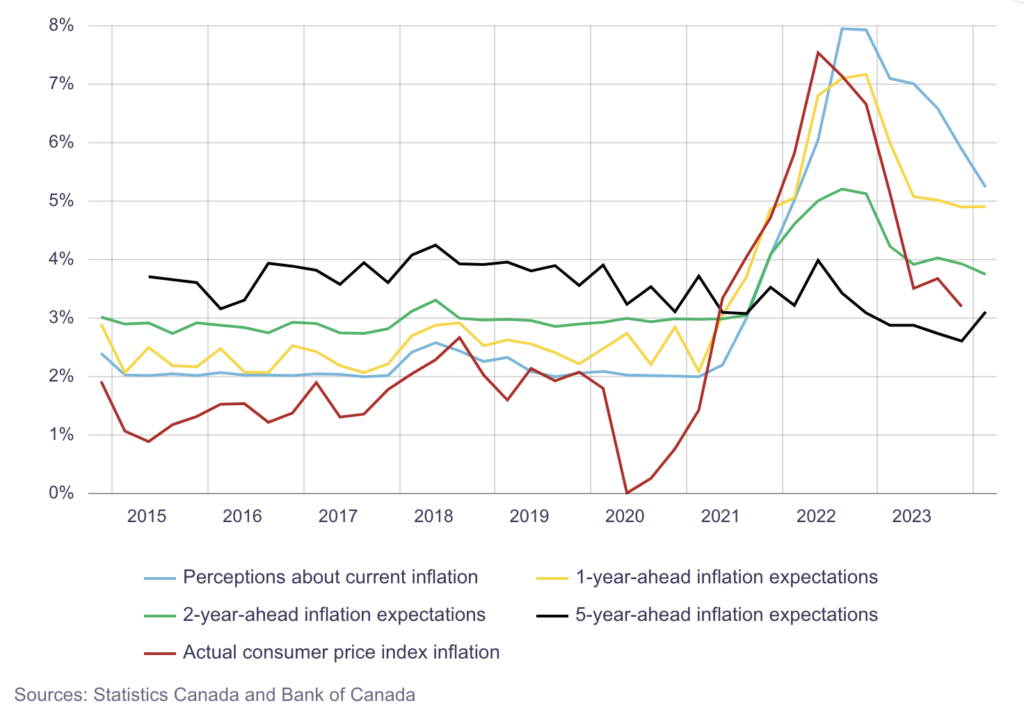

Canadians believe that inflation has decreased compared to the previous quarter. However, their expectations for near-term inflation have remained largely unchanged. Traditionally, changes in perceptions of inflation affect consumers’ expectations for near-term inflation, but this relationship has weakened in recent quarters.

Consumer Perception of Inflation and Price Sensitivity

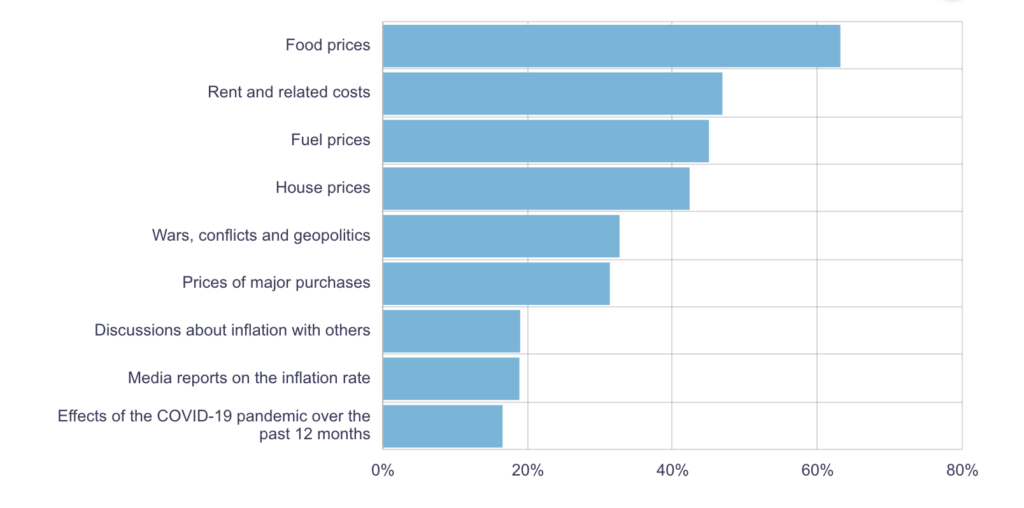

Customers often said that a major factor influencing their impressions of inflation is their own experience with costs when they purchase. When the price of something they usually buy changes, people notice it. About 60% of respondents to this quarter’s study said that food prices had a significant impact on how they perceive inflation, compared to slightly less than half who said gas prices, rent, and housing expenses have a significant impact.

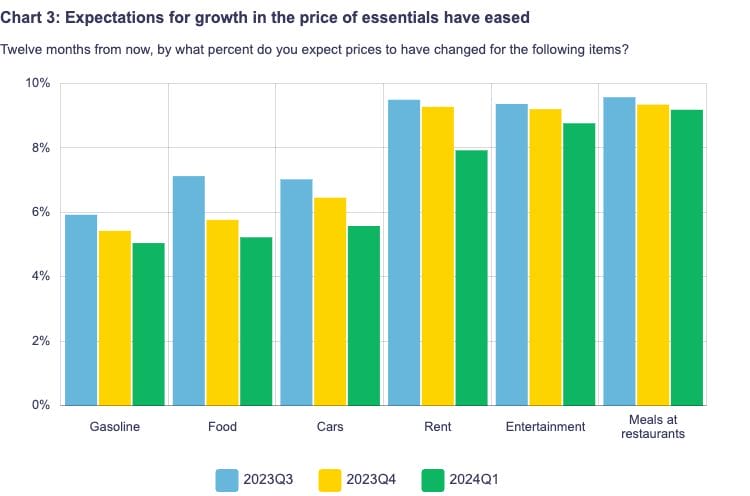

Consumer Perceptions of Price Growth for Essential Items

Consumer expectations for price growth in frequently purchased items, like food and gas, have eased since last quarter. These lowered expectations are likely influenced by perceptions of slowing price growth for these essential items. As noted regarding food prices, “Things are not going up as quickly as they were—price increases I see this year are smaller than last year.

Consumers anticipate near-term inflation to stay high even if they believe it is declining. They said in follow-up interviews that they anticipate inflation to be high in the foreseeable future in part because of the high interest rates. As one person put it, “What Canada is imposing on us are interest rates.” In my opinion, that adds to inflation.

Long-term inflation expectations rose for the first time since the second quarter of 2022, although they are still somewhat below average. From 37% to 41% of consumers, more people now anticipate long-term inflation to be higher than 5%. Consumers still believe that the primary drivers of high inflation are increased government spending, rising housing and rent expenses, and both. Customers anticipate that these tendencies will take longer to rectify than they did last quarter.

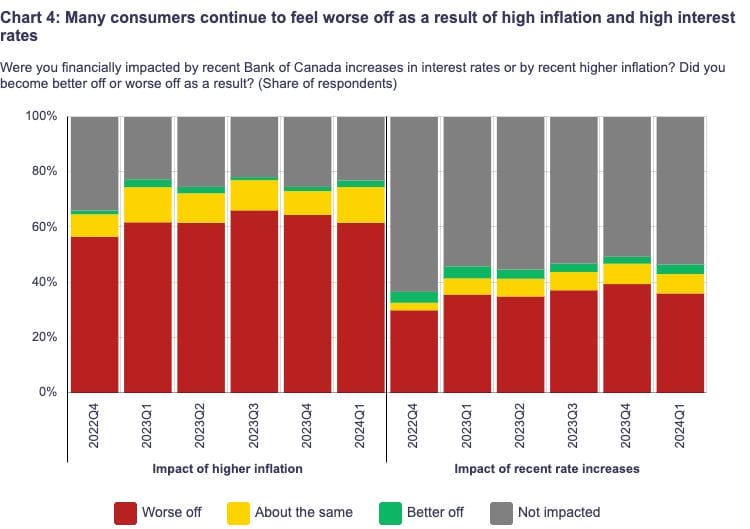

Impact of Inflation and Interest Rates on Consumer Sentiment

Despite ongoing challenges, consumer sentiment is showing signs of improvement regarding the effects of inflation and interest rates on their spending. The cost of living remains a top financial concern, but there is a slight decrease in the number of consumers feeling worse off compared to the previous quarter. This suggests that the negative impacts of inflation and interest rates may be stabilizing.

Consumer Behaviour and Economic Outlook

Consumers have been adapting to high inflation and interest rates by altering their behavior. They are employing various strategies to preserve their purchasing power, such as limiting vehicle usage to save on gas, reducing spending at restaurants, shopping at multiple stores to take advantage of sales, and buying groceries less frequently but in larger quantities. While there has been a slight decline in major purchases made over the past six months, intentions to make such purchases in the future remain subdued. However, there is a continued expectation to purchase services like vacations or major events, especially among those who have delayed such purchases.

Despite these challenges, there is an improvement in confidence regarding the economic outlook. This positive change is primarily driven by expectations of lower interest rates, following several quarters of high expectations for interest rates. Consequently, consumers are feeling less pessimistic about their financial situations. While indicators of household financial stress have improved compared to a year ago, they remain high relative to historical levels, posing a significant concern. This financial stress can impact households, leading to adjustments in consumption plans.

This quarter, mortgage holders also showed decreased levels of financial stress. This is probably a reflection of lower interest rate forecasts. Less mortgage holders anticipate a significant rise in their payments upon renewal—23% in the first quarter of 2024 compared to 31% in the fourth quarter of 2023. When they renew their mortgage, they also still have faith in their ability to handle the higher payments.

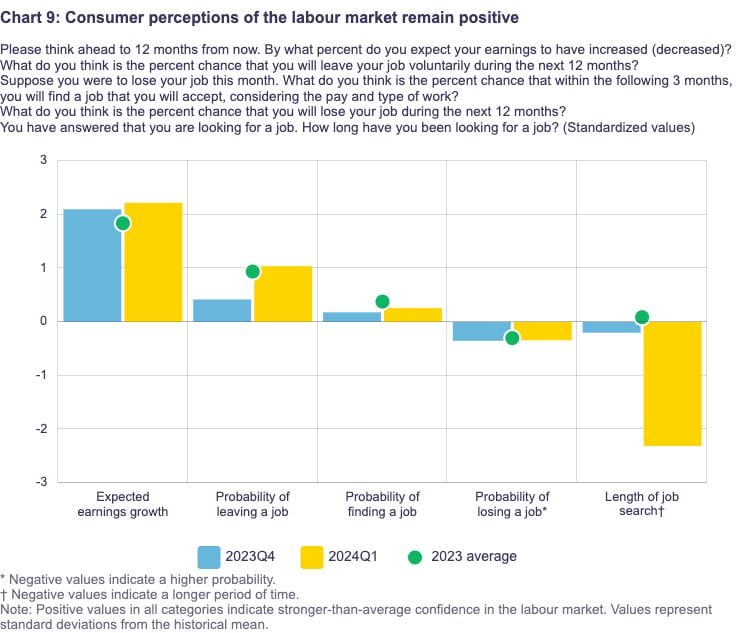

Stabilization in Labour Market Perceptions

After a period of softening over the past few quarters, consumer perceptions of the labor market seem to have stabilized. Most indicators of labor churn, such as the probability of finding or losing a job, remain relatively unchanged from the previous quarter.

Despite the fact that job seekers spend more time searching than in the previous quarter, generally, workers are still more optimistic about their career prospects than they have ever been. They said that they would be more likely than normal to quit their jobs willingly, and they still anticipate faster-than-average salary rise. Although they continue to get employment offers, some are dubious about the quality of these chances. One respondent said in a follow-up interview, “It seems like the job market is still doing well since I heard that employment is still growing in Canada. I’m not sure, however, whether the new positions pay well.

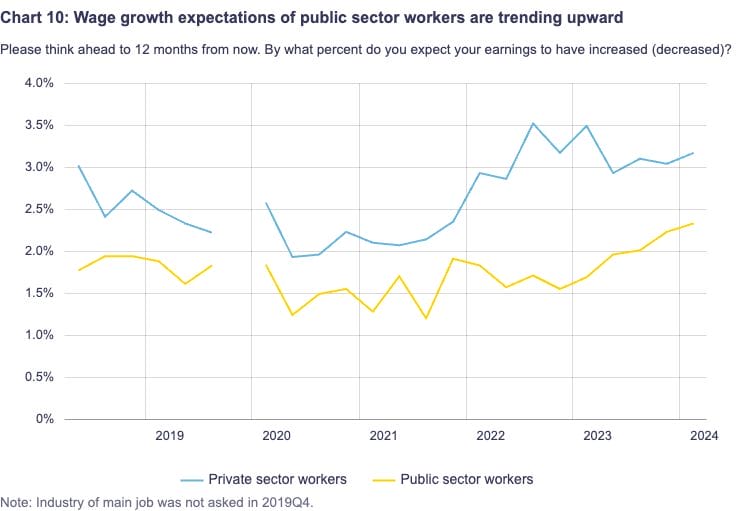

Wage Growth Expectations and Factors Driving Them

Wage growth expectations have reached a survey high of 2.8%, with the cost of living remaining a key factor for workers when considering their wage growth expectations. While employees in the public sector typically report lower wage growth expectations than those in the private sector (2.3% compared to 3.2%, respectively), recent quarters have seen expectations increase more rapidly among public sector workers than their private sector counterparts. This stronger growth in the public sector may be attributed to collective bargaining agreements.

Final Thoughts

The latest data from Cashin Mortgages indicates a nuanced outlook among Canadians regarding inflation. While perceptions of current inflation have eased, expectations for the near future remain largely unchanged, driven by personal experiences with rising costs of essentials like food and fuel. However, there is a growing belief that factors contributing to high inflation, such as government spending and housing costs, will take longer to resolve.

Despite these concerns, there are signs of improving sentiment. Canadians are starting to feel less pessimistic about the economy and their finances, with fewer planning to cut or delay spending. This improved sentiment is also reflected in perceptions of the labor market, which have stabilized, with workers anticipating stronger wage growth. However, the impact of high inflation and interest rates on budgets is still significant, with nearly two-thirds of Canadians adjusting their spending habits in response. Contact Cashin Mortgages for more information.

Read and download our latest Monthly Economic Report.