Housing Market

A Shortage Of Single Housing Is Coming

Ontario, Canada, finds itself in the throes of a housing crisis, particularly pronounced in its major cities. Over the past decade, soaring prices have dashed the dreams of homeownership for many. Meanwhile, the supply of housing—across all types—lags behind the demands of a growing population. In this blog, we’ll dissect the reasons behind this crisis and discuss potential solutions. Additionally, we’ll highlight the pivotal role Cashin Mortgages, a trusted mortgage partner in Ontario, plays in helping prospective homeowners navigate these challenging times.

The Housing Shortage in Ontario

Ontario stands out as having the largest housing shortage in all of Canada. Although other provinces face undersupply issues, Ontario’s situation is particularly acute.

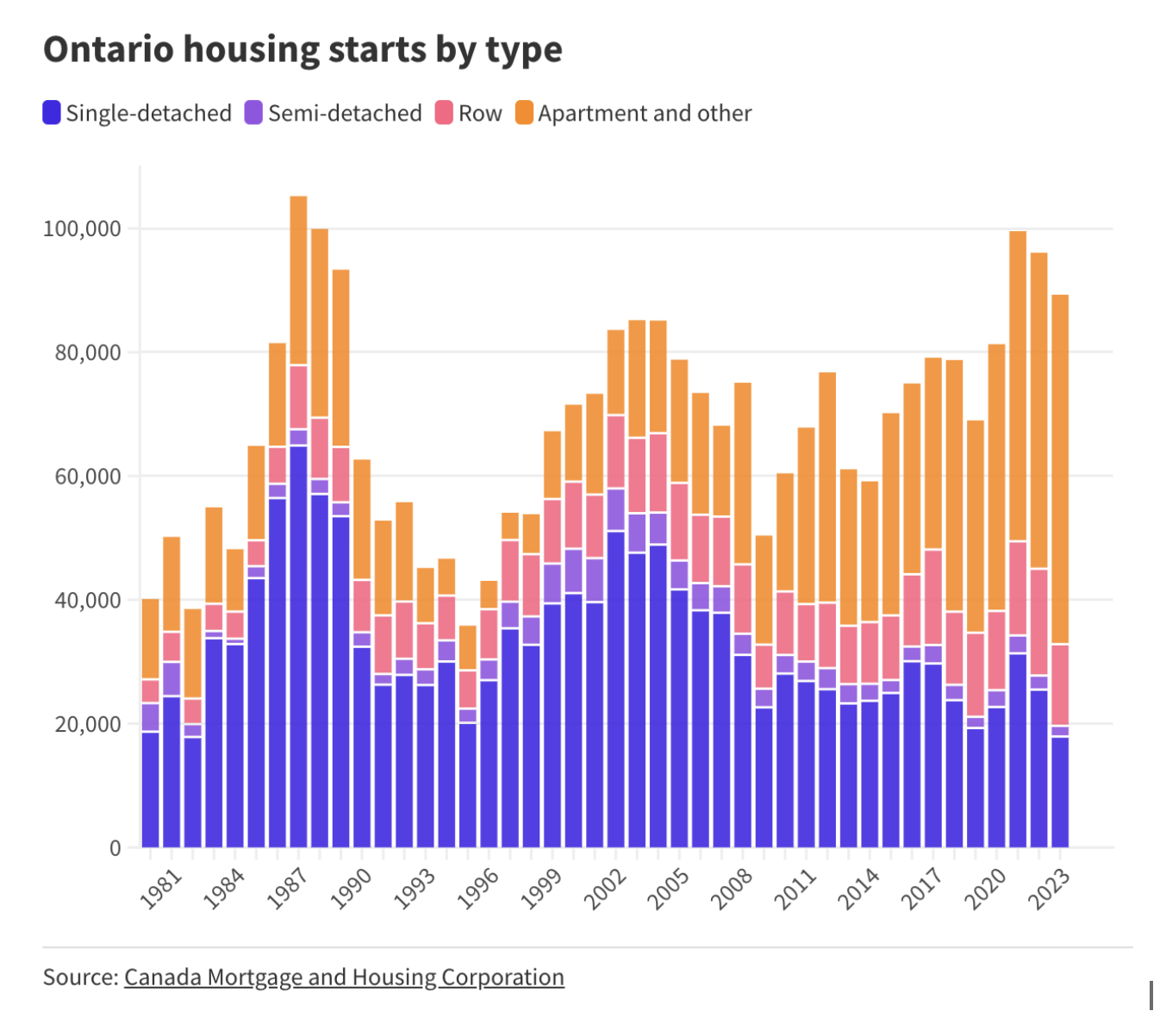

Housing starts in Canada fell in 2022 and 2023 by a cumulative 11% (or 31,000 units). We estimate growth in Canada’s housing stock fell short of new households by 170,000 units during the pandemic (between 2019 and 2023). Here are some key points:

Supply and Demand Imbalance

Ontario’s population continues to surge, but the supply of housing isn’t keeping pace. The demand for both market housing and rental housing far exceeds what’s available. Supply Gaps Estimate (SGE) report from June 2022, which estimated how much additional housing supply is required to restore affordability to 2004 levels by 2030. This new estimate shows the overall national supply gap remains at approximately 3.5 million more housing units by 2030, over and above what is already projected to be built by that time.

“We need market housing. We need rental housing. We need affordable housing,” emphasizes David Amborski, director of the Centre for Urban Research and Land Development at Toronto Metropolitan University. Unfortunately, the province is falling short on all fronts.

Government Targets vs. Municipal Plans

Premier Doug Ford set an ambitious target of building 1.5 million homes within a decade, based on recommendations from the government-commissioned Housing Affordability Task Force. However, many of Ontario’s 444 municipalities have growth plans that fall significantly short of these figures. In short, municipalities simply aren’t planning for enough housing.

Challenges in Building Housing

A Challenging Market

Developers are facing market conditions that make it challenging to keep up with demand. A shortage of skilled workers in the construction industry means there were some 82,000 unfilled positions across the country at the end of June . The pandemic led to dramatic increases in building material prices, further complicating the situation.

Labour Shortage

The construction industry struggles to find enough skilled workers to maintain the pace of new construction. The shortage affects project timelines and delays completion.

Material Costs

Building materials, including lumber, steel, and concrete, have become more expensive due to supply chain disruptions. These cost increases impact project feasibility and affordability.

Services Offered By Cashin Mortgages

Our comprehensive range of services includes:

The Role of Mortgage Providers

As a mortgage financing company, Cashin Mortgages plays a crucial role in helping borrowers navigate the challenges of the housing market. With the shortage of single-family homes likely to persist in the coming years, Cashin Mortgages can provide tailored financing solutions to help borrowers secure the funding they need to purchase a home. Whether it’s a traditional mortgage, a home equity loan, or another type of financing, Cashin Mortgages can work with borrowers to find the right solution for their needs.

Cashin Mortgages: Your Trusted Partner

At Cashin Mortgages, we’re more than just a mortgage company. Our dedicated team of professionals is committed to redefining the home financing experience for our clients. Here’s how we contribute to addressing the housing shortage:

Client-Centric Approach

Our mission is to revolutionize the mortgage industry by delivering unparalleled value and exceptional services. We prioritize client satisfaction, ensuring that our solutions align with their needs and aspirations.

Innovation and Expertise

We constantly refine our mortgage process and stay updated with industry knowledge. Our technology is upgraded to offer the best solutions to clients.

Community Engagement

We believe in thriving communities. Positive community initiatives enrich everyone’s lives. Beyond securing mortgages, we secure dreams and aspirations.

Conclusion

The shortage of single housing in Ontario poses a significant challenge that requires urgent attention and concerted action. Ontario’s housing shortage requires urgent attention. As voters head to the polls, consider candidates who prioritize housing solutions. Whether you’re a first-time homebuyer or an investor, let’s embark on this exciting journey together. Contact us at 416.655.CASH (2274) or book a call to discuss your homeownership dreams. At Cashin Mortgages, we don’t just secure mortgages; we secure futures.