Market Update:

Bank of Canada Cuts Rates and What It Means for You

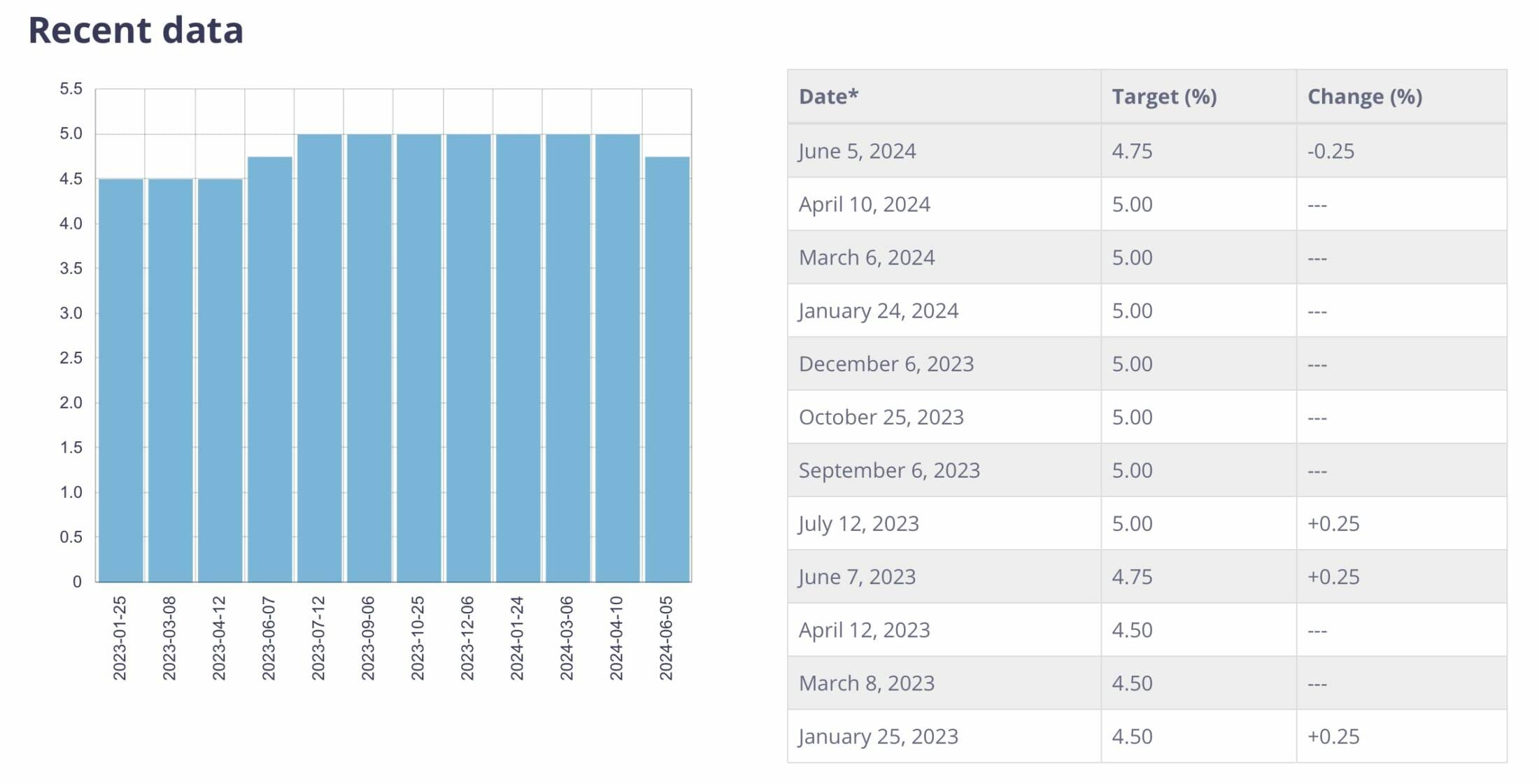

The Bank of Canada recently cut its key interest rate by a quarter of a percentage point to 4.75%, marking the first rate cut in over four years. This change has significant implications for various financial products, including mortgages, loans, and investments. In this blog, we will explore the effects of this rate cut and navigate these changes.

Source: Bank of Canada

Why Did the Bank of Canada Cut Rates?

Central banks cut interest rates to stimulate economic activity. Lower rates make borrowing cheaper, encouraging businesses to invest and consumers to spend. Conversely, high rates can help cool an overheating economy and control inflation. The recent rate cut by the Bank of Canada was driven by several factors:

Economic Slowdown

Signs of a slowing economy, such as reduced consumer spending and business investment, often prompt rate cuts. Lower rates aim to boost economic activity.

Inflation Control

While Canada’s inflation rate has been relatively stable, global economic uncertainties can influence domestic inflation. Lowering rates can help manage these pressures.

Global Economic Factors

Global events, such as trade tensions or economic slowdowns in major economies, can impact Canada. Lower rates help insulate the Canadian economy from these external shocks.

What Does It Mean for You?

A Positive Sign for First-Time Homebuyers

The recent interest rate decrease is a welcome development for first-time homebuyers. Over the past two years, the Bank of Canada rapidly raised its policy rate to combat inflation, leading to higher prime rates and mortgage rates. This increase made it more challenging for many to afford homes, causing a slowdown in the housing market. The current rate cut is a positive signal that the Bank of Canada is willing to ease monetary policy to support economic growth and housing affordability.

Although the 25 basis point decrease may not significantly impact mortgage costs immediately, it is widely considered the start of a trend of lowering rates. As rates go down, mortgage-related costs will also decrease, making it more accessible for new buyers to enter the market. This development is particularly important for first-time homebuyers who have been waiting for rates to cool before making a move. The rate cut may inspire new buyers to ramp up their home search efforts as confidence in the economy grows, leading to an improvement in housing affordability and options.

Relief for Variable Rate Mortgage Holders

Variable-rate mortgages work in different ways depending on the lender and the structure of the mortgage. For some, as the prime rate goes up, mortgage payments automatically increase. For others, mortgage payments stay the same even in the face of a rate increase, but the mortgage amortization period gets longer as less of the payment is applied to the principal of the mortgage.

With the recent rate decrease, the effect on variable rate mortgage holders will depend on how their mortgage is structured. If their mortgage is such that payments go up and down in response to the lender’s prime rate, their payments may automatically decrease. Otherwise, a lower rate means more of their mortgage payment will be directed towards the principal amount of their mortgage, allowing them to pay off their mortgage faster than in a higher-rate environment.

Mortgage Impact

The rate cut will result in immediate savings for borrowers with variable-rate mortgages. For example, someone with a $600,000 mortgage and a 25-year amortization at a 6% interest rate would save approximately $88 per month if the rate were 5.75%. However, those with fixed-rate mortgages will see their payments change once their loans are renewed.

Mortgage Renewers Will Still Feel the Impact of Higher Rates

While the interest rate reduction is positive news for homeowners, many mortgage holders renewing in the next 6-12 months will still feel the impact of higher rates compared to their current mortgage term. For those who took out a mortgage in 2022 or earlier, the Bank of Canada’s policy rate could have been as low as 0.5%, meaning a mortgage rate at or around 2%. With today’s policy rate more than 4% higher than the 2022 low, those renewing their fixed-rate mortgages will face significantly higher rates than they have been used to. These individuals need to understand their new payments and budget accordingly.

Savings Account and GIC Rates

Savings accounts and guaranteed investment certificates (GICs) have seen higher returns as rates rose. If prime rates go down, these rates could also decrease. The relationship between borrowing costs and savings rates is not strictly linear, but banks typically lower savings rates to compensate for lower lending rates. This could be a good time to compare shops, as smaller banks, digital banks, and credit unions may keep savings rates higher to attract customers.

Prime Rate and Borrowing Costs

The Bank of Canada’s benchmark rate affects borrowing costs for banks, which means they can lower their lending rates but are not forced to do so. Banks are generally quick to raise their prime rates when the central bank hikes rates but have been less consistent in lowering them. However, when the central bank last lowered its rate four years ago, banks did follow suit within a day.

Expectations of Further Cuts

Economists predict that the Bank of Canada will cut rates further. Toronto-Dominion Bank forecasts two more cuts by the end of the year, bringing the benchmark rate to 4.25%, while Canadian Imperial Bank of Commerce and Royal Bank of Canada predict three more cuts, resulting in a rate of 4%. A full percentage point off the $600,000 mortgage would translate into about $349 in monthly savings.

Conclusion

The Bank of Canada’s rate cut has significant implications for various financial products. Borrowers with variable-rate mortgages will see immediate savings, while those with fixed-rate mortgages will not see changes until their loans are renewed. Lines of credit and credit cards will also be affected, with savings expected for lines of credit and no significant changes for credit cards. Savings account and GIC rates could also decrease if prime rates go down. It is crucial to review your financial situation and consider working with a mortgage broker like Cashin Mortgages to ensure you are making the best decisions for your financial future.

Sources:

bankofcanada.com

https://www.rbcroyalbank.com