Real Estate Market

A Comprehensive Look at the Current Real Estate Landscape

As we embark on a new year, we would like to keep you informed about the ever-changing world of real estate. In this blog, we dive into the recent trends that are shaping the Canadian housing market and influencing the decisions of both buyers and sellers.

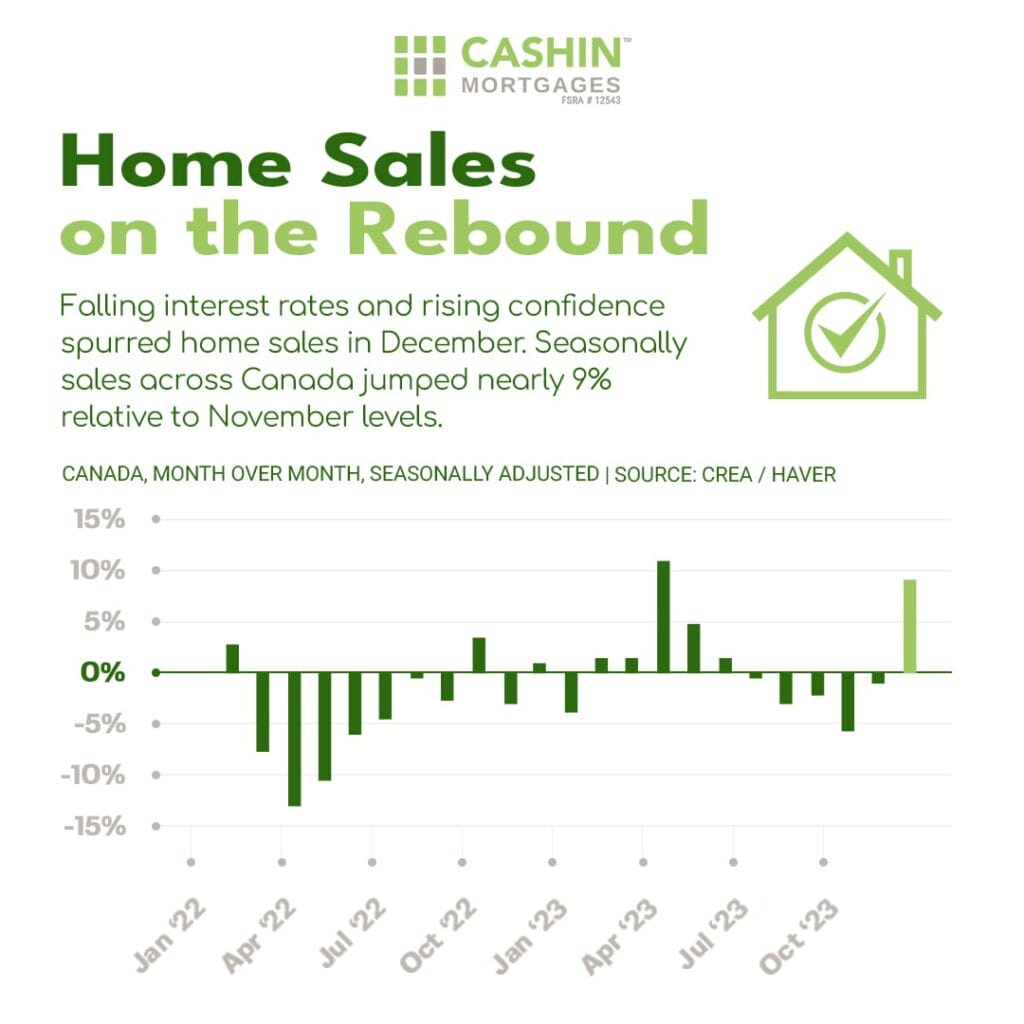

Home Sales Surge in December:

The end of 2023 witnessed a remarkable rebound in home sales across Canada. Fuelled by a combination of falling interest rates and a surge in confidence, December experienced a nearly 9% jump in sales compared to November.

This upward trajectory sets a positive tone for the real estate market in the coming months.

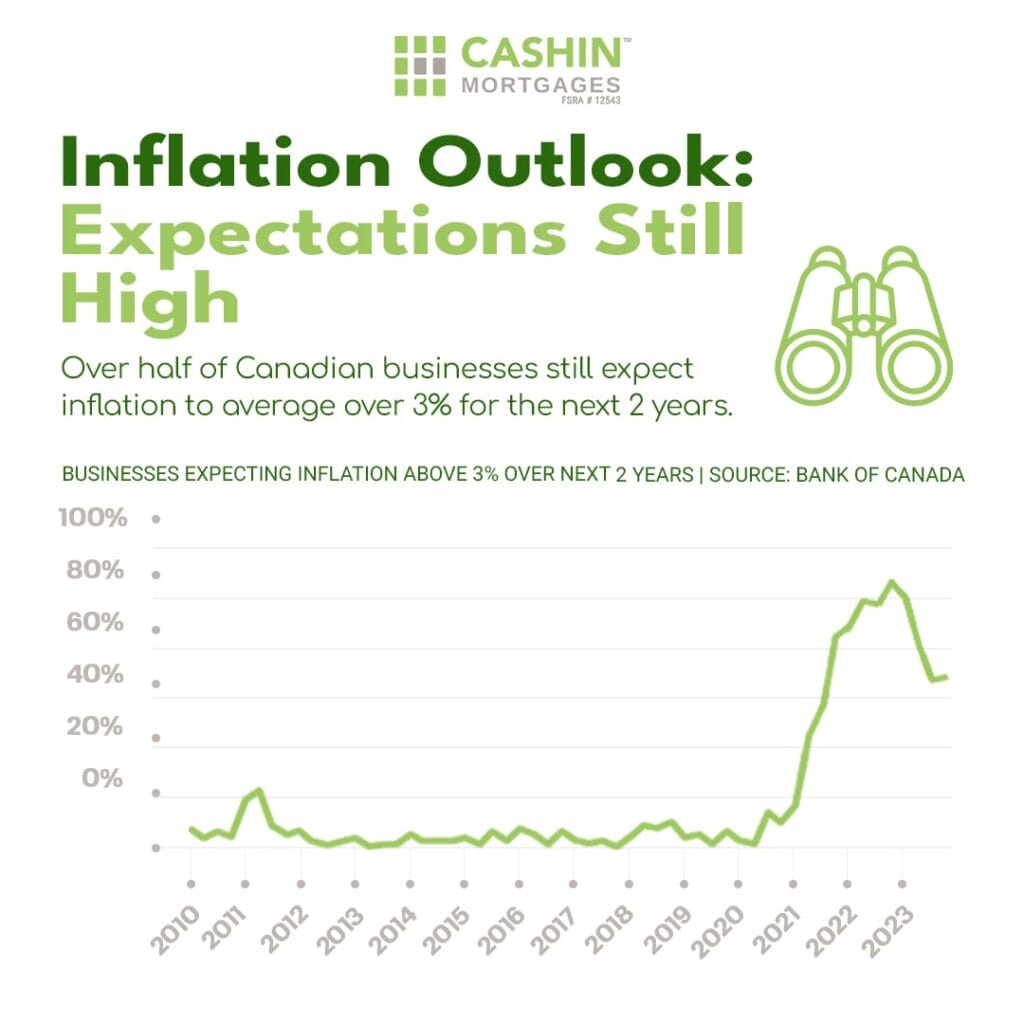

Inflation Expectations Remain High:

As we step into the new year, inflation remains a key player in the economic landscape. Over half of Canadian businesses anticipate an average inflation rate exceeding 3% for the next two years.

Understanding these inflationary pressures is crucial for homeowners and potential buyers as they plan their financial future.

Market Balance and Its Impact:

December brought about a notable improvement in market balance. A decline in new listings coupled with a rising demand pushed the national sales-to-new-listing ratio from 50% to a well-balanced 58%.

This equilibrium suggests a stable market, likely resulting in flat to slightly higher prices in the upcoming months.

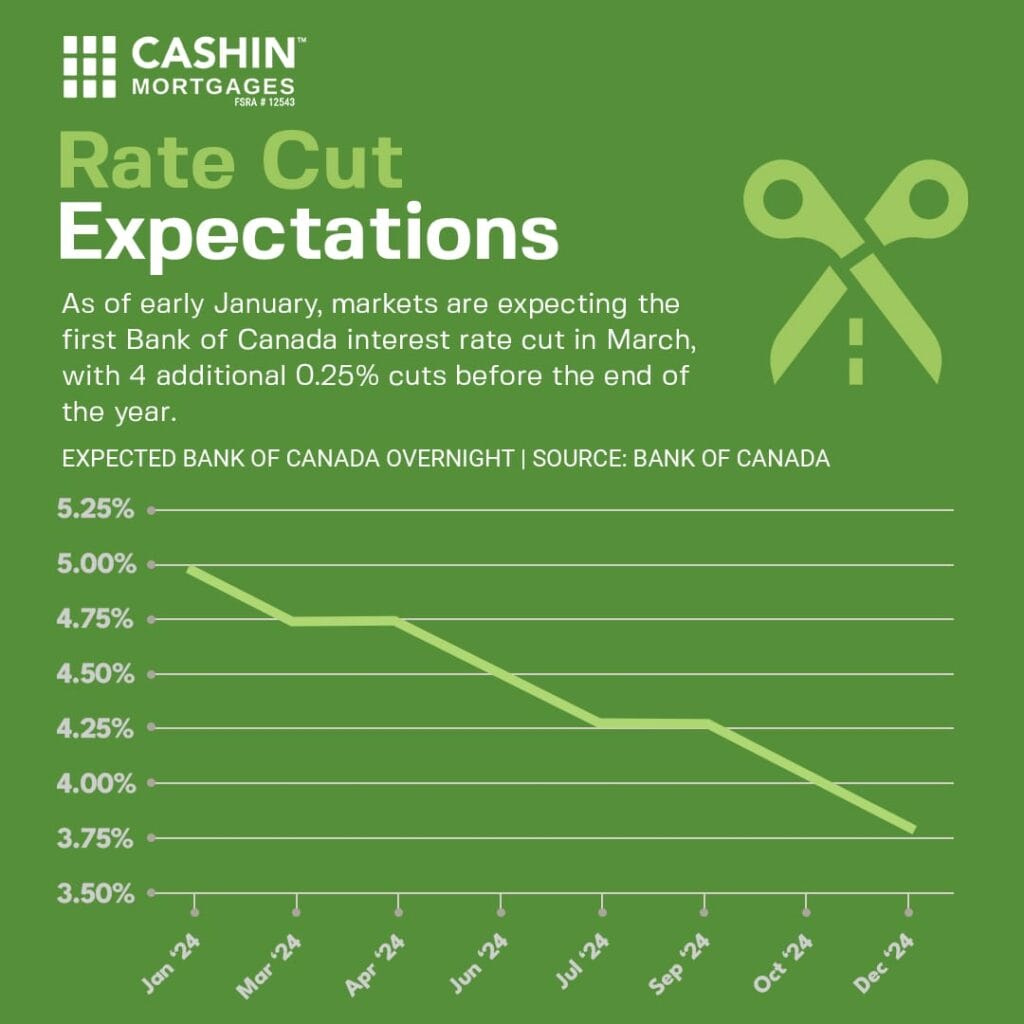

Anticipating Rate Cuts:

The financial markets are abuzz with expectations of the first Bank of Canada interest rate cut in early January, with speculations of four additional 0.25% cuts throughout the year.

These potential changes can significantly impact mortgage rates and financing options, making it essential for prospective homeowners to stay informed.

Single-Family Housing Trends::

The financial markets are abuzz with expectations of the first Bank of Canada interest rate cut in early January, with speculations of four additional 0.25% cuts throughout the year.

These potential changes can significantly impact mortgage rates and financing options, making it essential for prospective homeowners to stay informed.

In conclusion, the real estate landscape is dynamic, presenting both challenges and opportunities. Whether you’re a homeowner, a potential buyer, or someone considering a mortgage, staying informed is crucial. Keep an eye on market trends, inflation rates, and potential interest rate changes as you navigate the exciting journey of homeownership in 2024.

If you have any questions or need personalized advice, our team is here to assist you on your homeownership journey. Contact Us today