Market Insights:

Trends Impacting Housing and Mortgages

As we step into the heart of 2024, it’s crucial to stay abreast of the dynamic shifts in our economy, particularly those influencing the housing and mortgage markets.

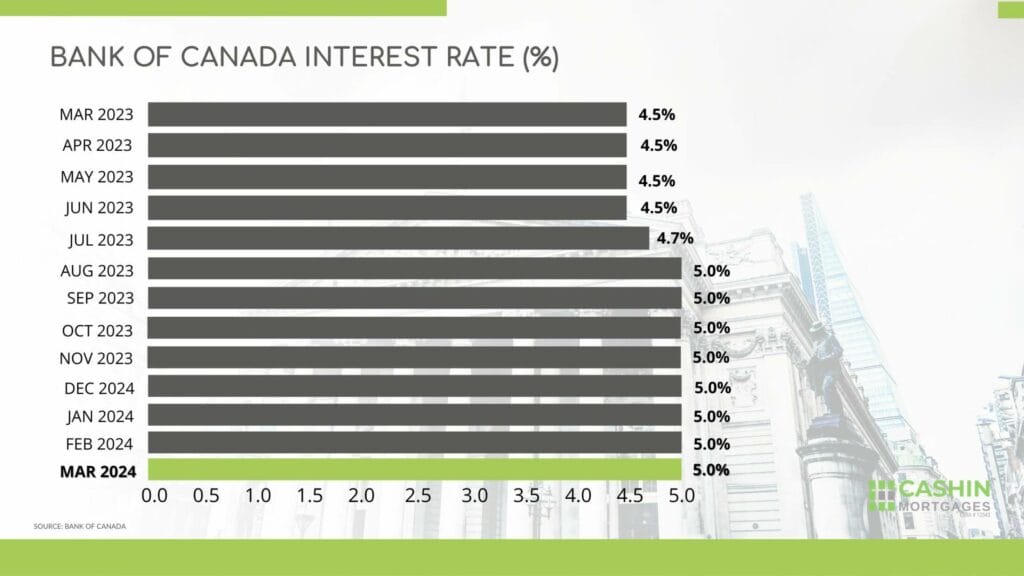

Furthermore, today’s rate update from the Bank of Canada has maintained the overnight rate at its current level of 5%. This decision comes amidst considerations of economic recovery, inflationary pressures, and global uncertainties.

Click here to view the Bank of Canada Rate Hikes timeline.

Now, let’s dive into the other key developments:

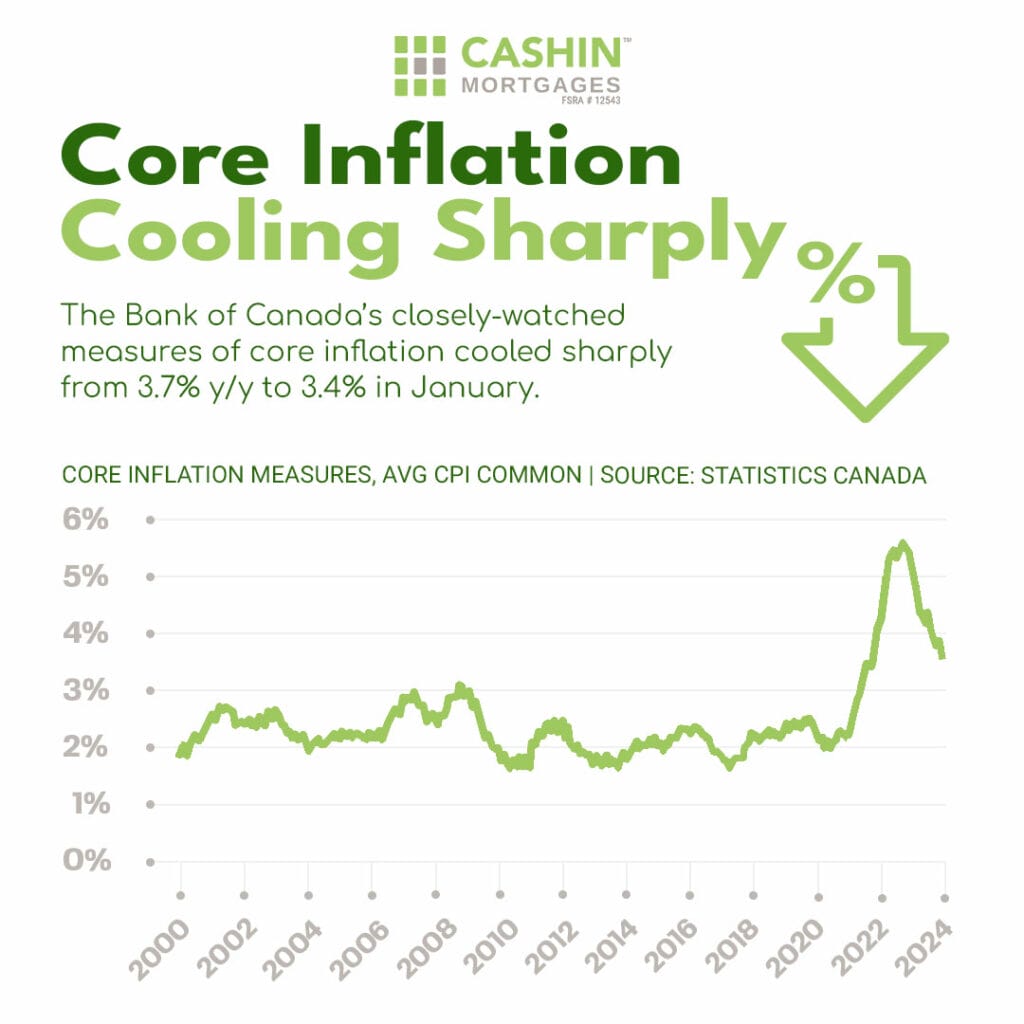

Core Inflation Cooling Sharply: The recent data released by the Bank of Canada unveils a notable drop in core inflation from 3.7% to 3.4% in January. While this may signal a moderation in price pressures, it’s imperative to remain vigilant as fluctuations in inflation could significantly impact monetary policy decisions.

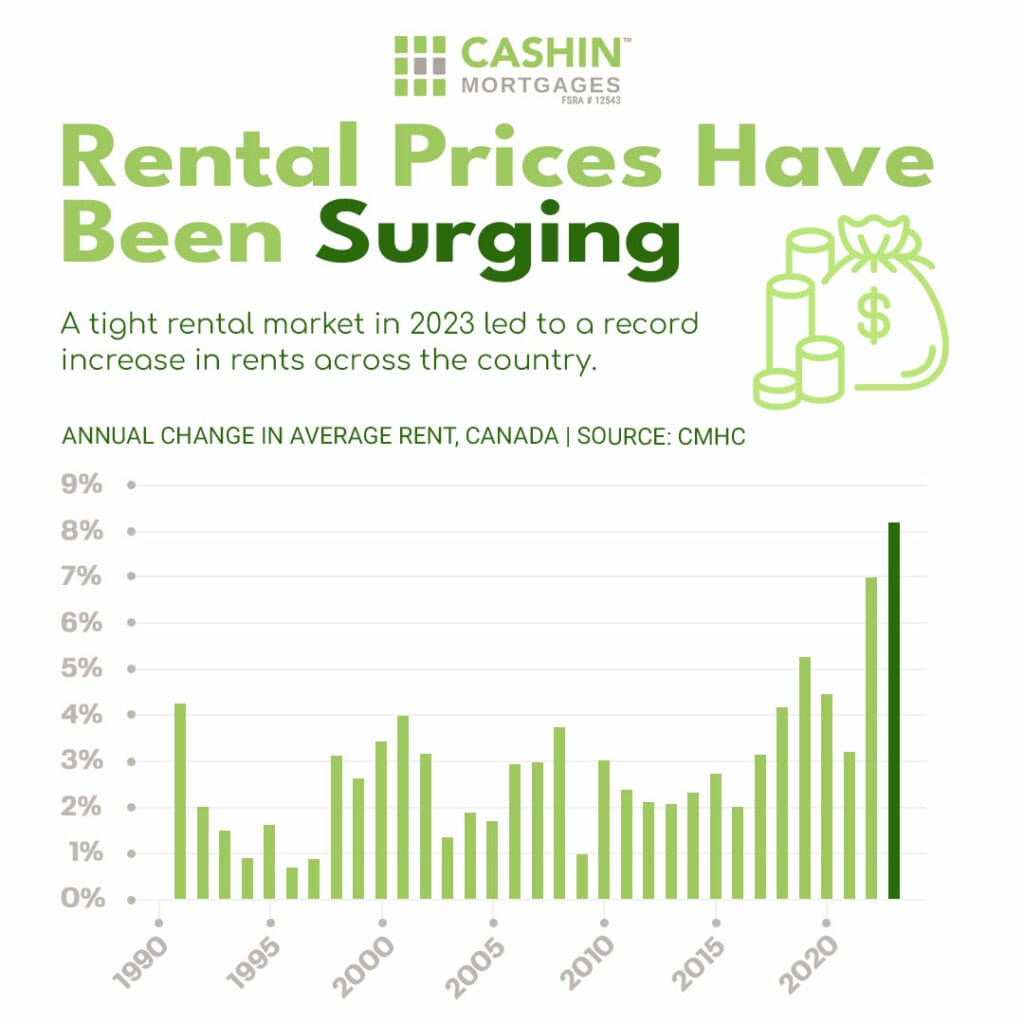

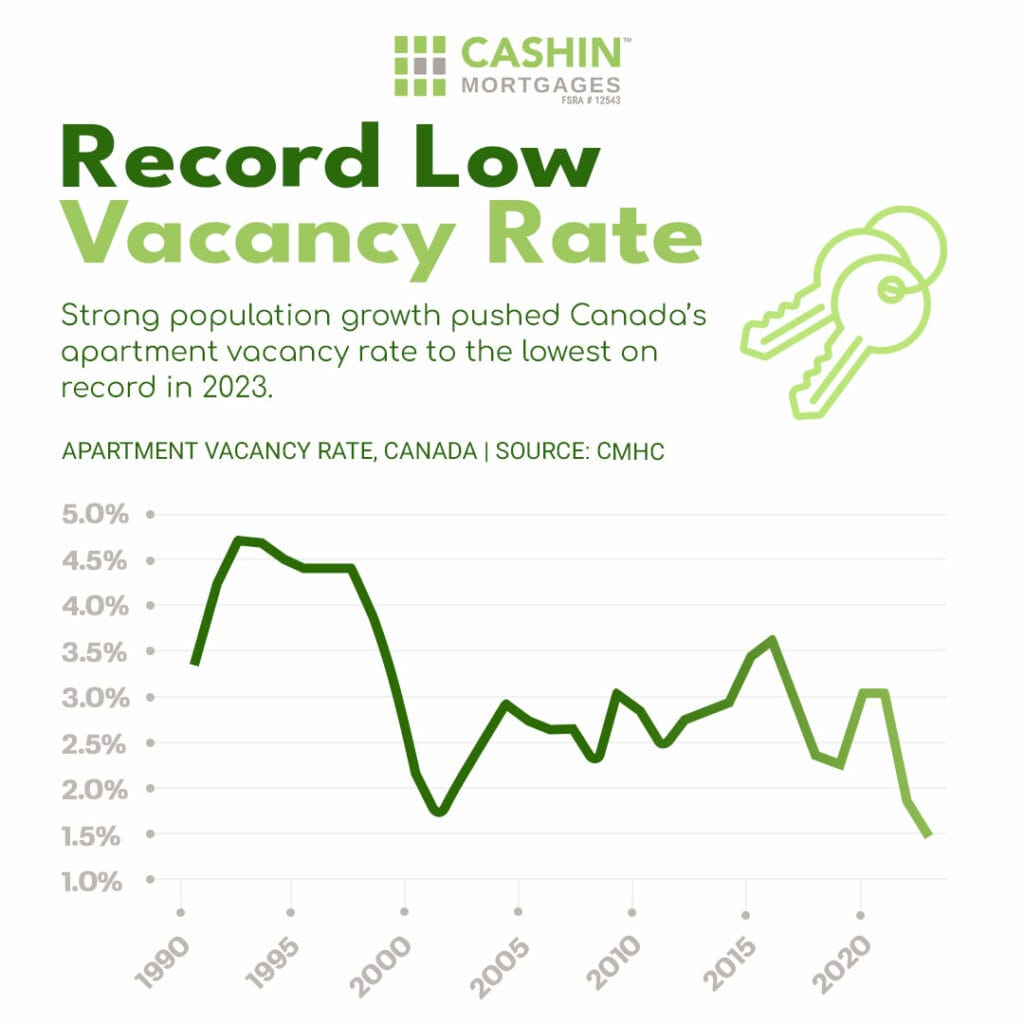

Surging Rental Prices: Throughout the course of 2023, we witnessed an unprecedented tightening in the rental market, leading to record-high rents across the country. This surge underscores the challenges renters face amidst limited housing availability and robust demand.

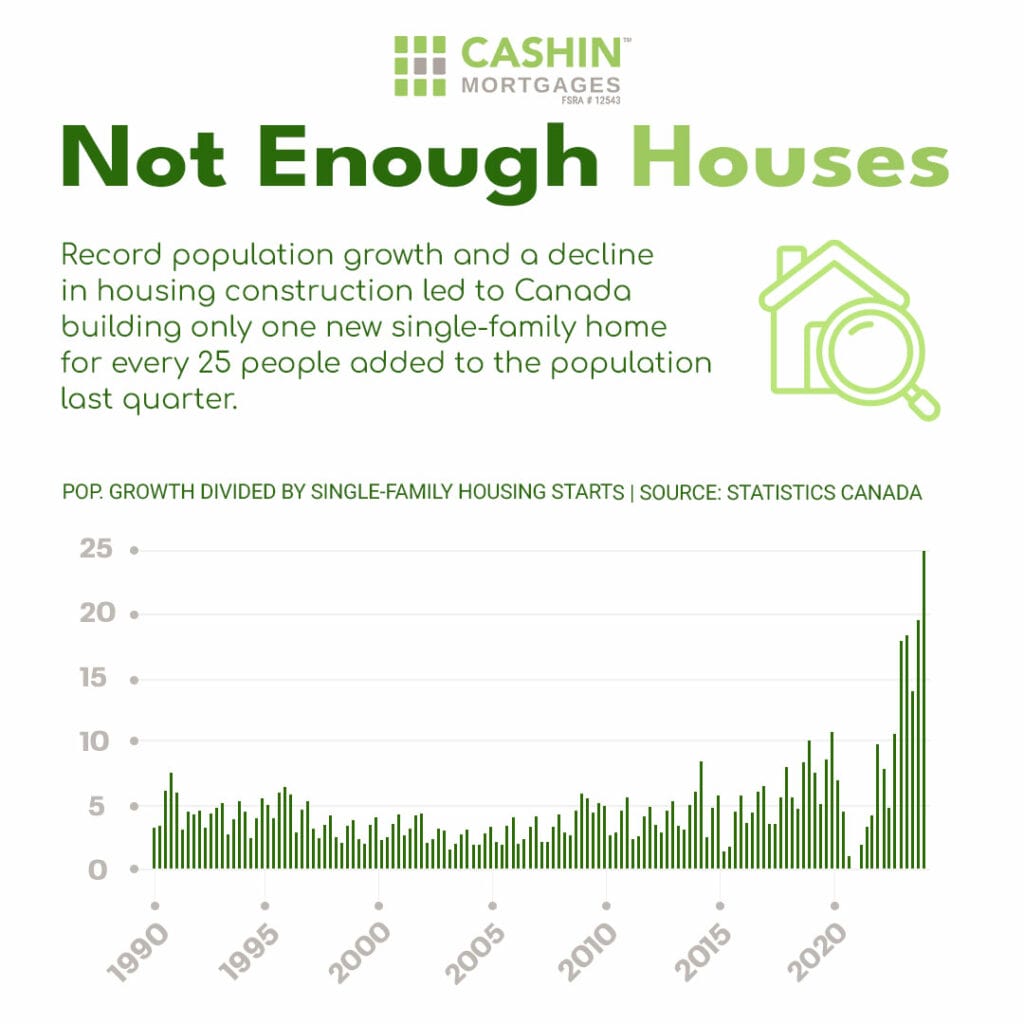

Housing Construction Shortfall: Canada is grappling with a pressing housing shortage exacerbated by rapid population growth and a decline in housing construction. Shockingly, for every 25 people added to the population last quarter, only one new single-family home was built. This underscores the urgent need for increased housing supply to meet the burgeoning demand.

Record Low Vacancy Rate: The strong population growth experienced by Canada has propelled the apartment vacancy rate to its lowest level on record in 2023. This trend highlights the tightness of the rental market and the challenges individuals encounter in finding affordable housing options.

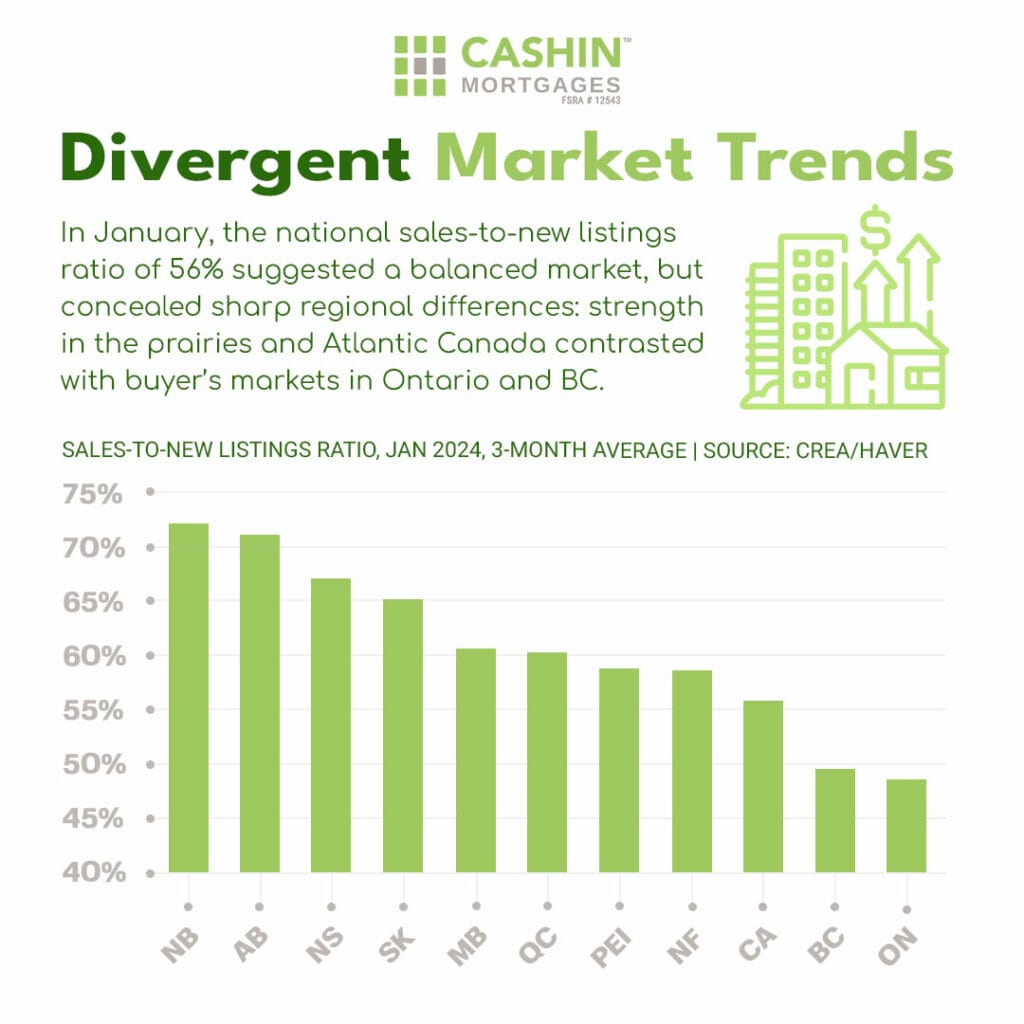

Divergent Market Trends: Despite a national sales-to-new listings ratio of 56% indicating a balanced market in January, significant regional disparities were evident. While the Prairies and Atlantic Canada demonstrated resilience, Ontario and BC faced buyer’s markets, reflecting divergent trends across the nation.

As your trusted mortgage brokerage, We am here to guide you through these market intricacies and provide tailored solutions to address your unique needs.

If you have any questions or require further assistance, please don’t hesitate to reach out to us.