Monthly Market Update:

Key Insights and Trends for June 2024

Welcome to our June 2024 Market Update! This month, we dive into the latest economic trends and insights shaping the Canadian market landscape. Alongside the headline news of the Bank of Canada’s rate adjustment, we explore other pivotal factors influencing various sectors.

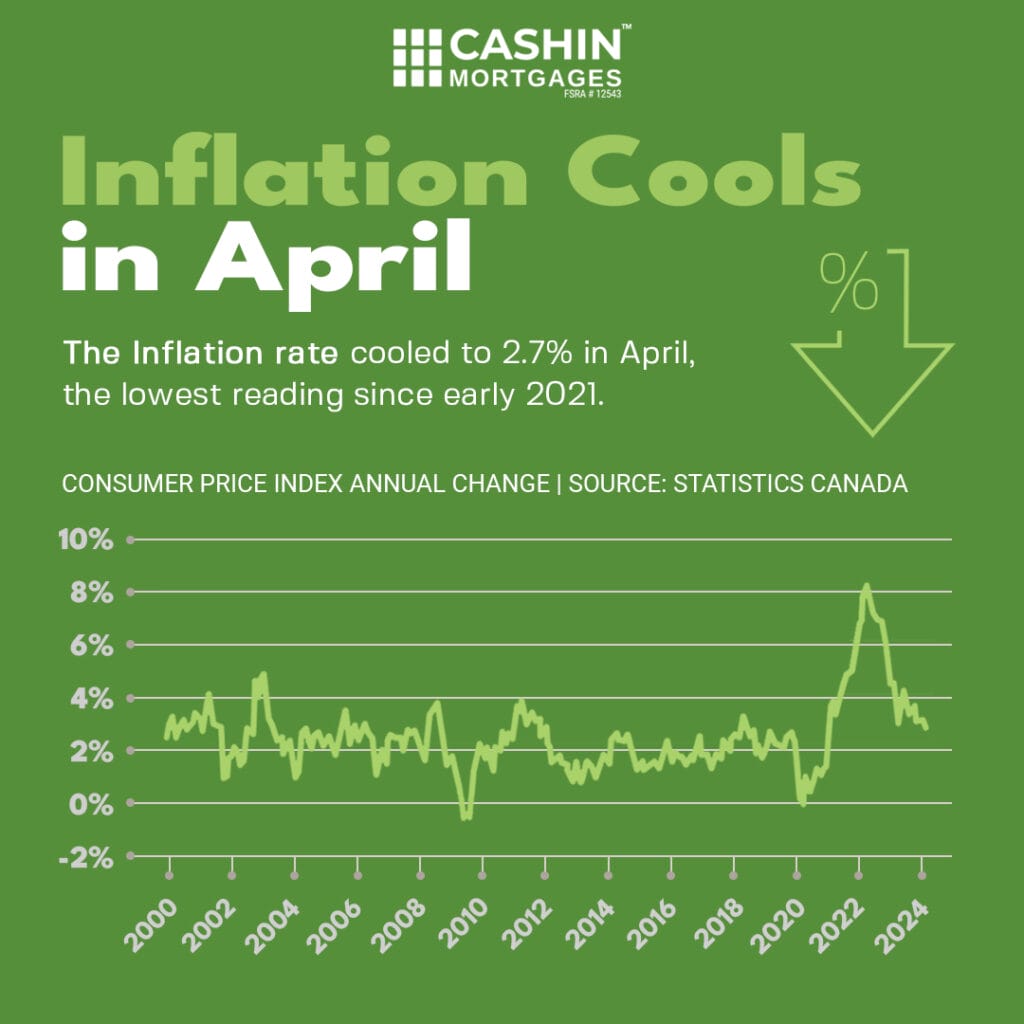

Inflation Cools in April

Did you know that inflation showed signs of easing in April? After months of scrutiny, the inflation rate dropped to 2.7%, its lowest since early 2021. This development is a positive indicator for both consumers and businesses, hinting at potential price stability on the horizon. The decline suggests that the Bank of Canada’s assertive monetary policies might be yielding results, fostering a more predictable economic environment.

Key Takeaways:

- Inflation Rate: Fell to 2.7% in April.

- Implications: Potential stabilization of prices, alleviating cost pressures for consumers and businesses.

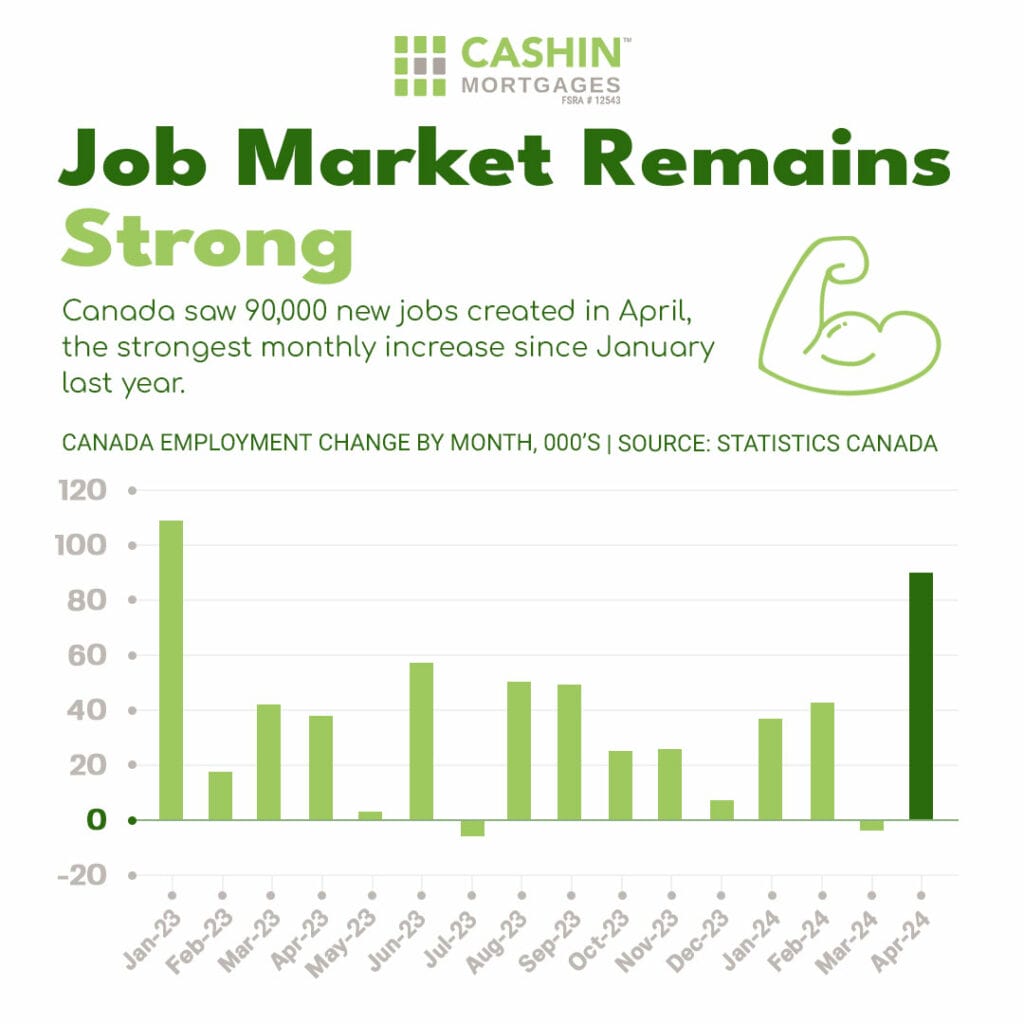

Job Market Remains Strong

Despite economic fluctuations, Canada’s job market remains resilient. April witnessed the creation of 9,000 new jobs, marking the most significant monthly increase since January of the previous year. This robust performance underscores the economy’s strength and offers optimism to job seekers nationwide.

Key Takeaways:

- Job Creation: 9,000 new jobs added in April.

- Implications: Continued labor market strength, positive employment outlook.

Housing Market Dynamics

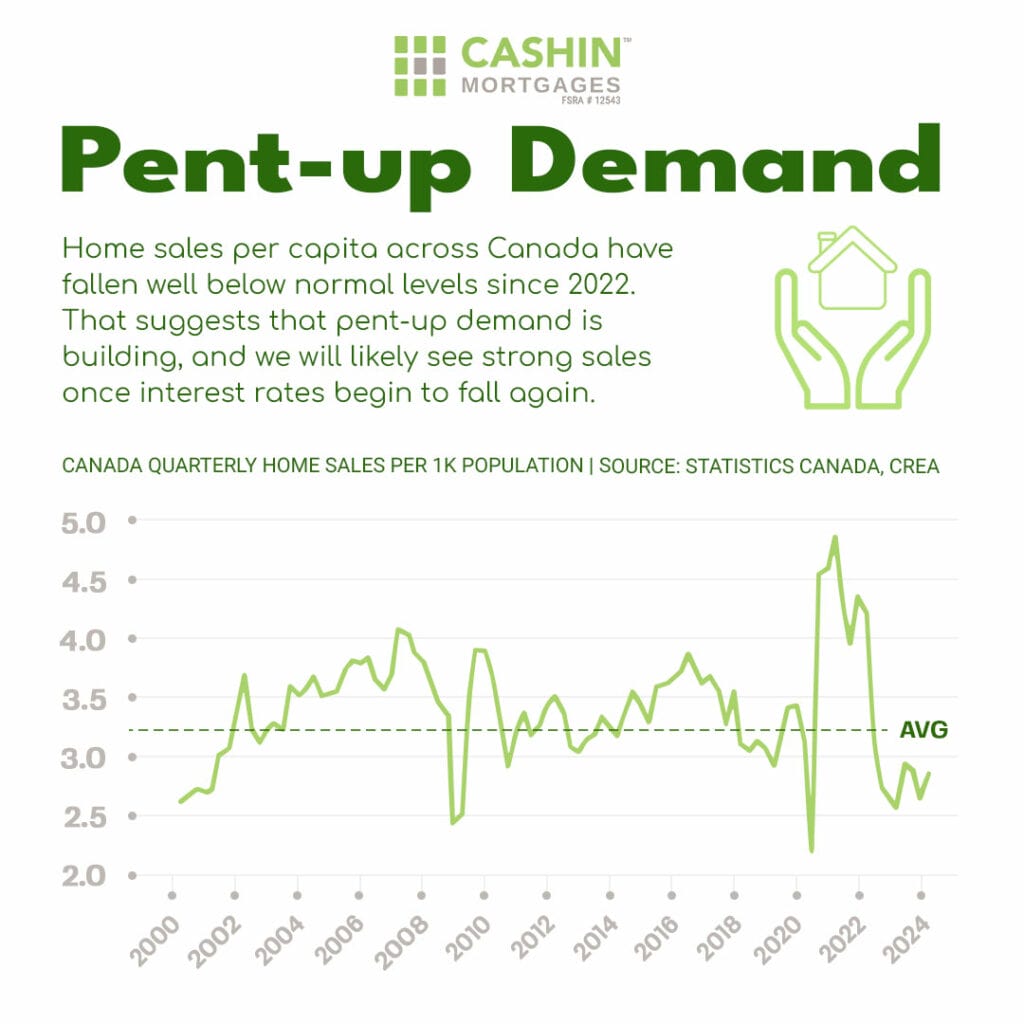

Decreasing Home Sales

Since 2022, home sales per person in Canada have exhibited a downward trend, indicating a mounting backlog of demand in the housing sector. With sales dropping below typical levels, there’s anticipation that a reduction in interest rates could trigger a surge in housing transactions. This presents opportunities for both buyers and sellers to capitalize on favorable market conditions.

Increasing Prices in Major Metros

Despite the overall decline in sales, the majority of Canadian metropolitan areas witnessed an uptick in house prices in April. This suggests that although fewer homes are being sold, demand remains robust enough to drive up prices, particularly in high-demand regions.

Key Takeaways:

- Home Sales: Decline since 2022, signaling pent-up demand.

- House Prices: Upward trend in most major metropolitan areas in April.

- Implications: Potential transaction surge with interest rate reduction, favourable conditions for market participants.

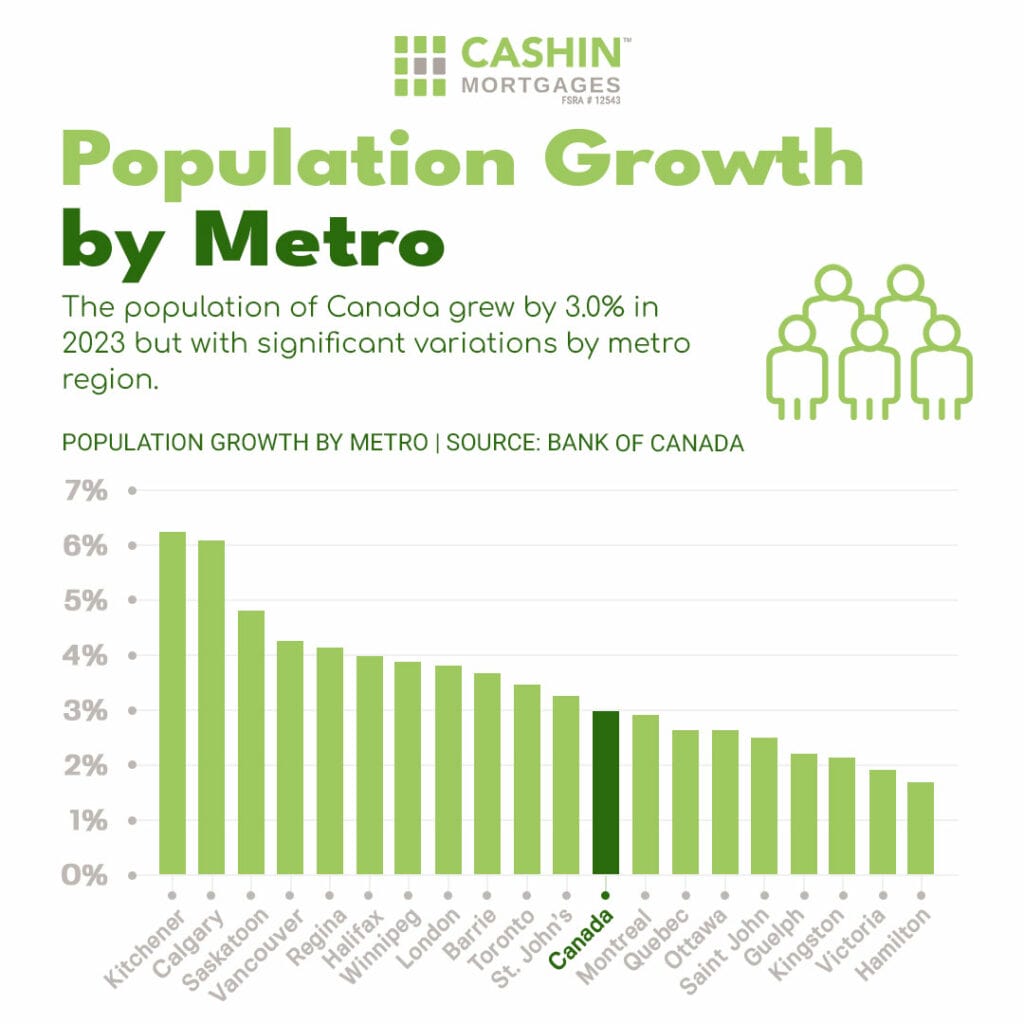

Population Growth and Its Implications

In 2023, Canada experienced a significant population growth of 3.0%. However, this growth varied considerably across metropolitan regions, showcasing diverse demographic trends and migration patterns. Understanding these disparities is critical for policymakers and businesses as they strategize for future infrastructure and service needs.

Key Takeaways:

- Population Growth: 3.0% increase in 2023.

- Regional Variations: Substantial disparities across metropolitan areas.

- Implications: Requirement for targeted infrastructure and service planning.

Bank of Canada Rate Update: Decreased to 4.75%

In the latest move by the Bank of Canada, interest rates have been reduced to 4.75%, effective immediately. This decision underscores the central bank’s efforts to stimulate economic activity and support recovery efforts amidst ongoing challenges. Business owners and consumers alike should pay close attention to how this rate adjustment may impact borrowing costs and overall financial strategies.

Conclusion

June 2024 presents a blend of promising indicators and strategic opportunities in the Canadian market. From the easing of inflation to a resilient job market and evolving housing dynamics, signs point towards potential stability and growth. As policymakers and businesses navigate these trends, staying informed and adaptable will be key to success.