The Canadian housing market has been a topic of great interest and discussion in recent times. Several factors have shaped the landscape, including a future supply crunch, record-breaking immigration levels, surging house prices, a shift towards a seller’s market, and concerns about rising inflation. In this blog, we will delve deeper into these factors and their impact on Canada’s housing market.

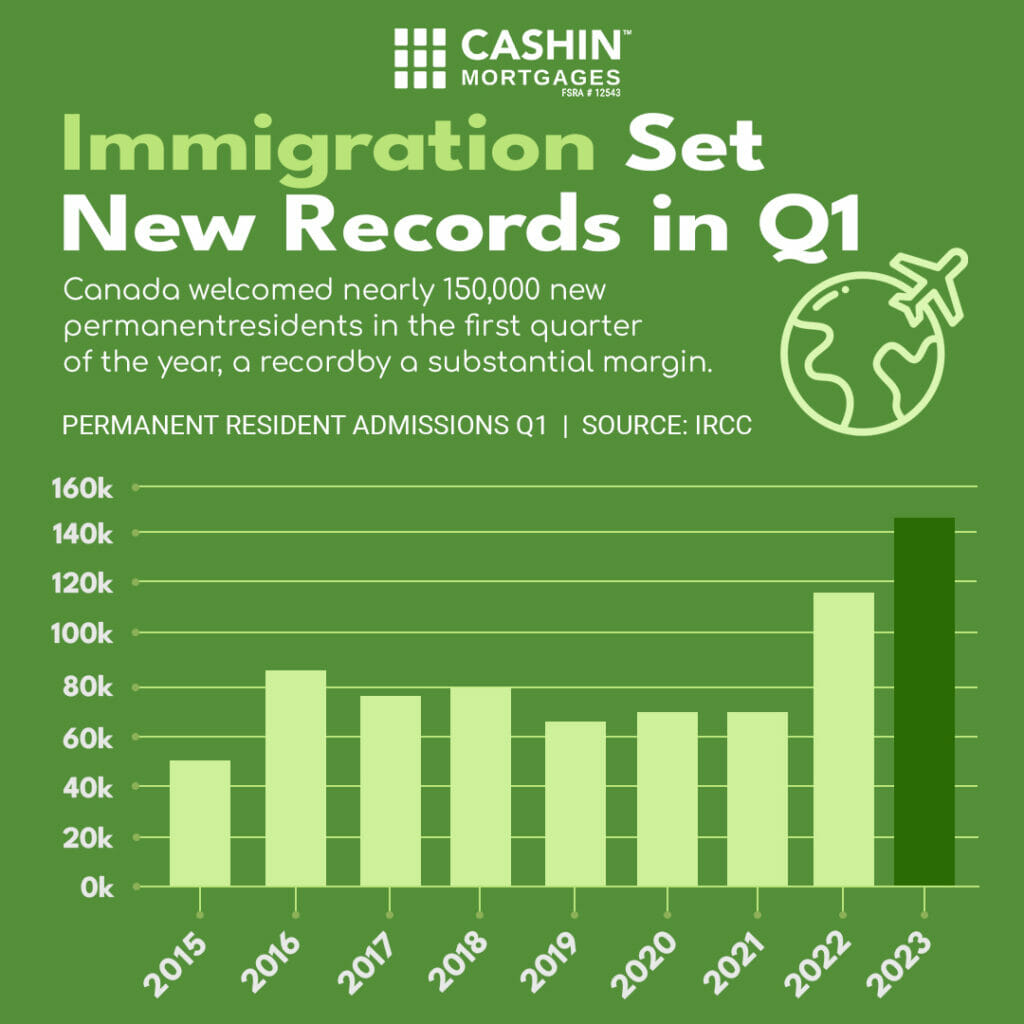

Record-Breaking Immigration in Q1: Canada’s immigration numbers have reached unprecedented heights, especially in the first quarter of 2023. Despite the challenges posed by the global pandemic, Canada has seen a remarkable influx of newcomers seeking opportunities and a better life. The federal government’s commitment to welcoming immigrants has played a significant role in setting new records for immigration levels.

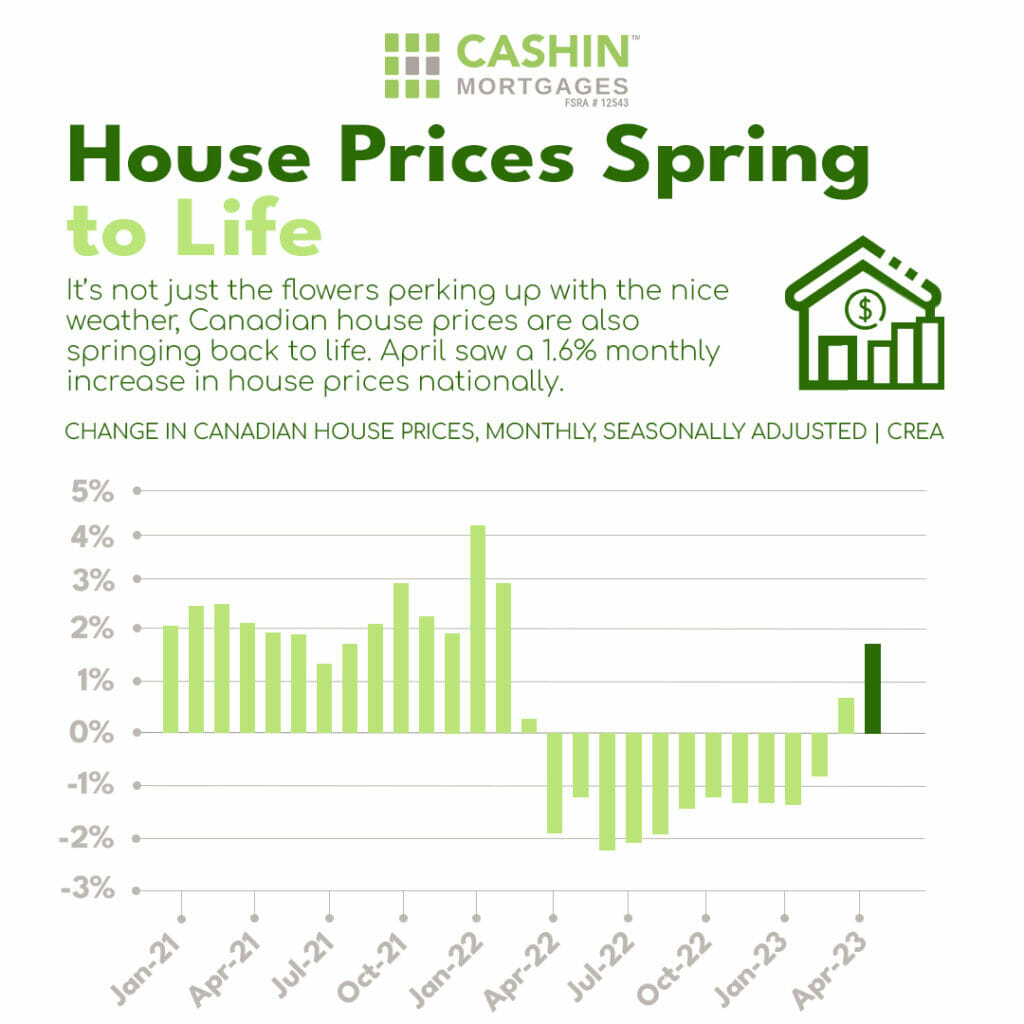

House Prices Springing Into Life: The Canadian housing market has experienced a significant increase in house prices, which has caught the attention of both homeowners and potential buyers. Low-interest rates, increased demand, and limited housing supply have contributed to the rapid price appreciation. While this has been a boon for homeowners, it has also raised concerns about affordability and accessibility for first-time buyers and those with lower incomes.

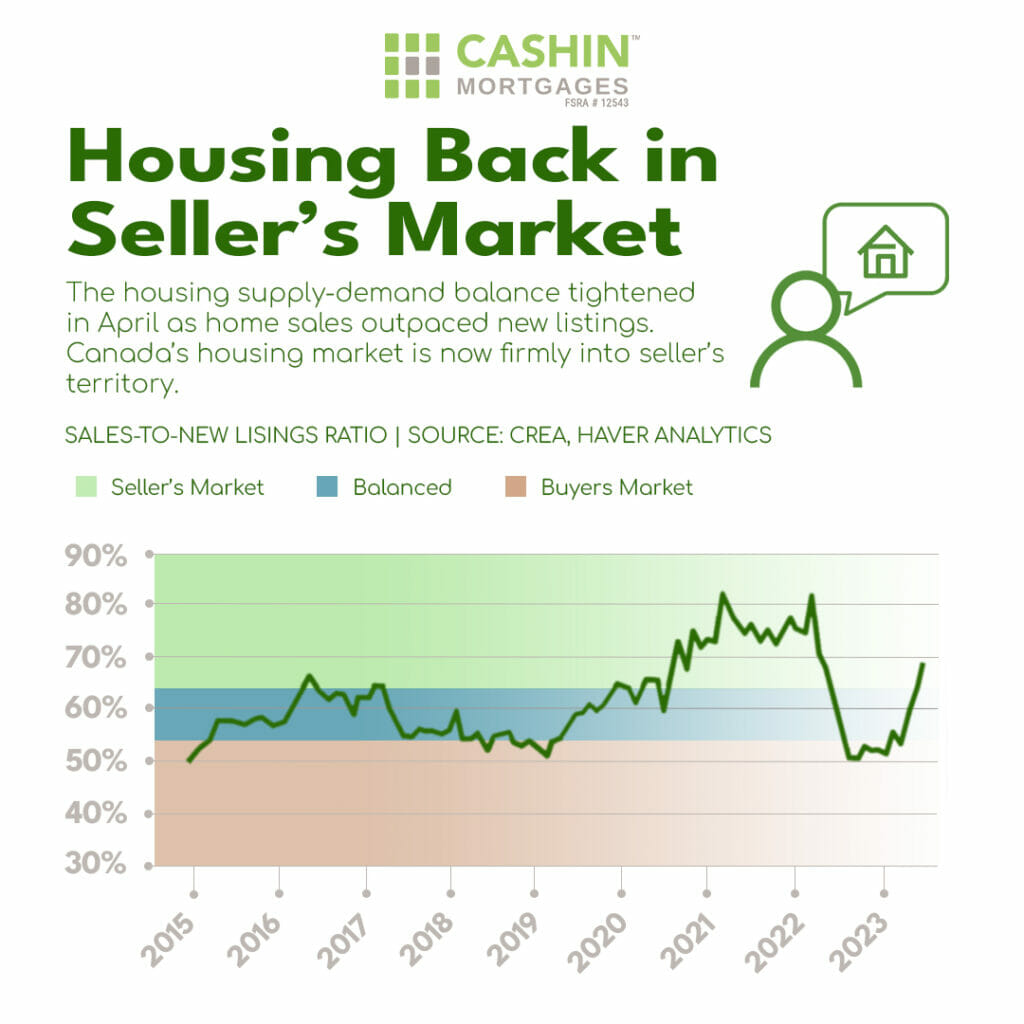

Housing Back in Seller’s Market: The dynamics of the housing market have shifted, with many regions transitioning into a seller’s market. In a seller’s market, demand exceeds supply, giving sellers the upper hand in negotiations. Bidding wars and multiple offers have become more common, putting pressure on buyers to act quickly and potentially pushing prices even higher.

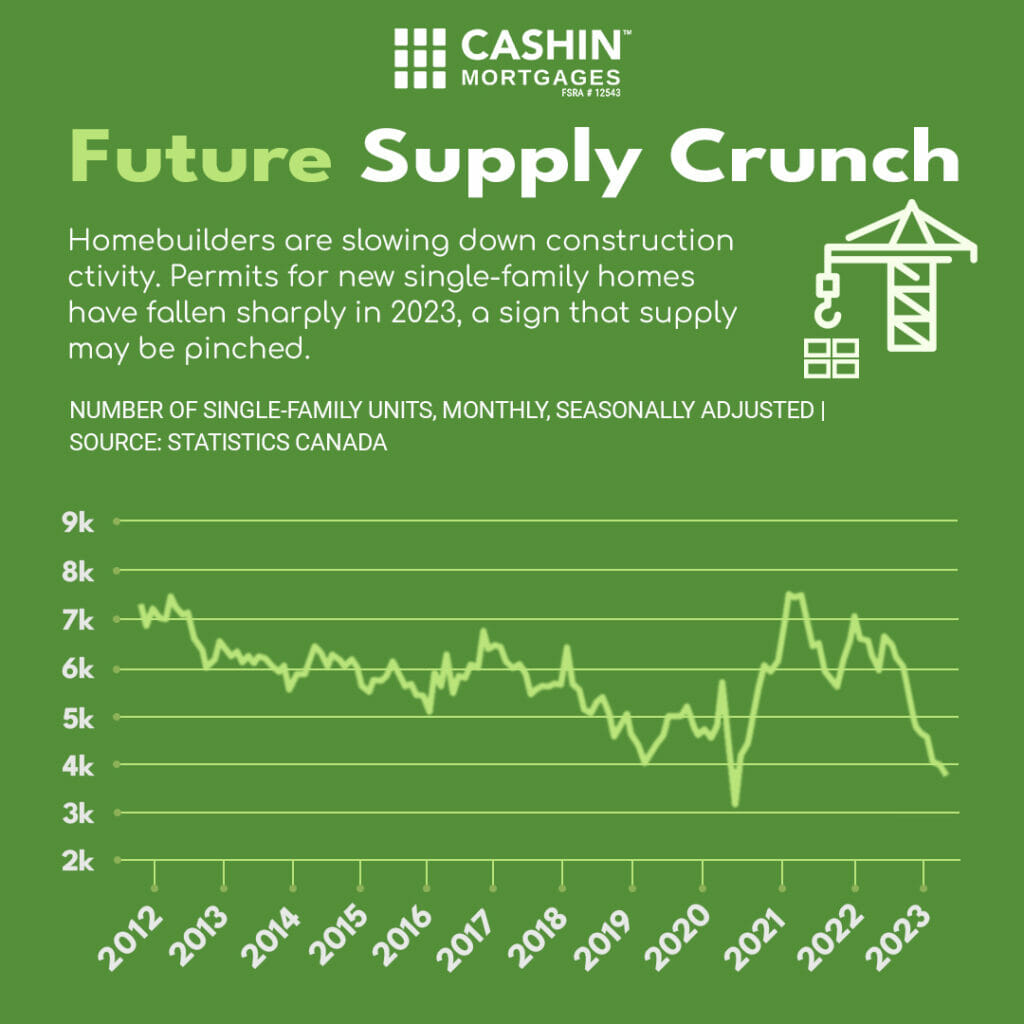

Future Supply Crunch Slowing Down Construction: One of the major challenges facing the housing market in Canada is a future supply crunch. As demand continues to outpace supply, especially in major cities, the construction industry is facing hurdles in keeping up with the growing housing needs. Factors such as rising construction costs, labour shortages, and lengthy approval processes have contributed to the slower pace of construction, exacerbating the supply-demand imbalance.

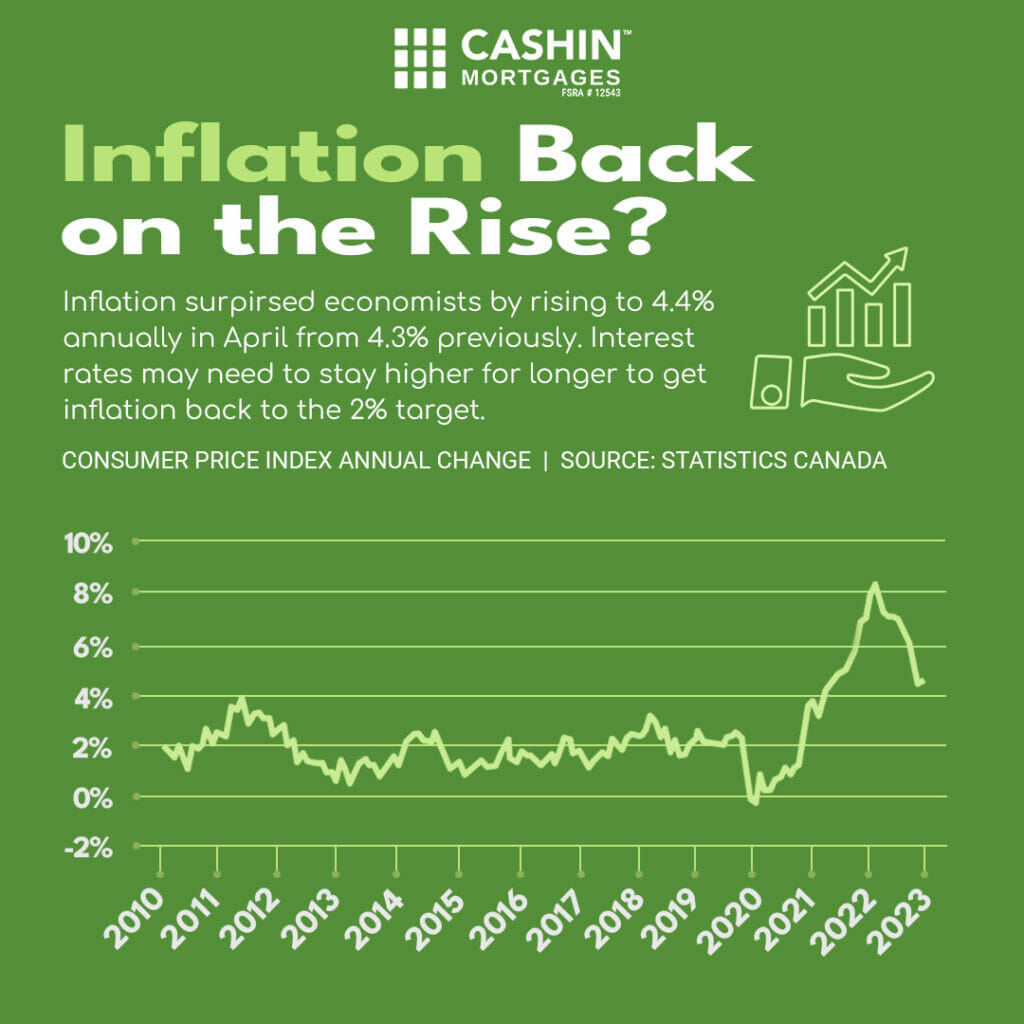

Inflation Back on the Rise: The resurgence of inflation has been a topic of concern across various sectors, including the housing market. Rising costs of building materials, labour, and other inputs can drive up construction costs, potentially leading to increased housing prices. Additionally, inflationary pressures can impact mortgage rates, affecting affordability for prospective homebuyers.

The record-breaking immigration numbers witnessed in Q1 2023 have made a significant impact on Canada’s housing market. The influx of newcomers has heightened housing demand, particularly in major urban centers, and put additional pressure on the already strained supply. As Canada continues to attract immigrants, it is crucial to address housing challenges proactively, ensuring affordability and accessibility for all residents.

Need a Mortgage? Contact Us

Source:

https://www.statcan.gc.ca/en/start